Managing personal finances can feel overwhelming with multiple expenses, subscriptions, and savings goals to keep track of. Thankfully, there are modern apps designed to simplify budgeting, track spending, and help you make smarter financial decisions. Here are the top 5 finance apps that can transform how you manage your money.

1. Mint – Comprehensive Budget Tracking

Mint is one of the most popular apps for managing personal finances.

- Automatically tracks spending by connecting to your bank accounts.

- Creates smart budgets and sends alerts when you overspend.

- Provides a full financial overview including bills, subscriptions, and credit scores.

Perfect for anyone who wants a simple, all-in-one money manager.

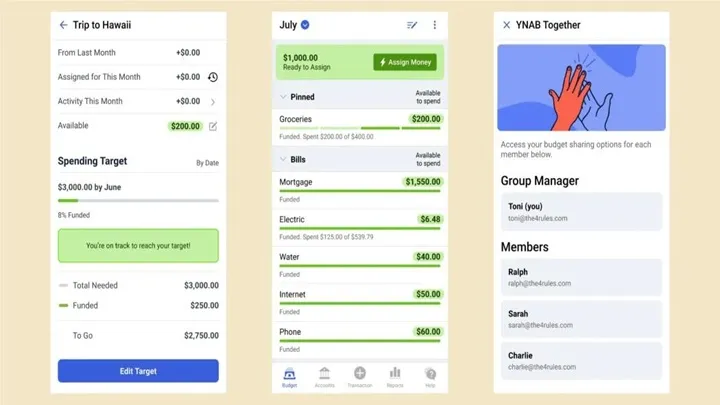

2. YNAB (You Need A Budget)

YNAB is built around a proactive budgeting philosophy, helping you assign every dollar a purpose.

- Focuses on giving every dollar a job—spend intentionally.

- Offers real-time budget syncing for families or couples.

- Includes workshops and guides to improve money habits.

Best for those serious about building long-term financial discipline.

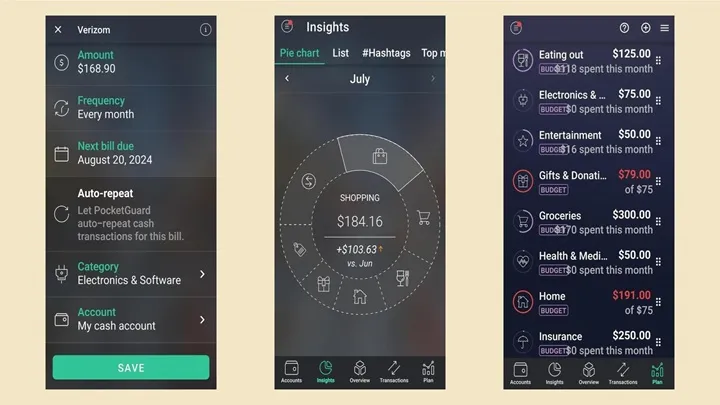

3. PocketGuard – Stop Overspending

PocketGuard is designed to keep things simple by showing you how much disposable income you have after bills and necessities.

- Automatically categorizes expenses.

- Shows how much “safe-to-spend” money remains.

- Helps reduce unnecessary spending.

Great for people who need quick, clear insights into their spending habits.

4. Goodbudget – Envelope Budgeting Made Digital

Goodbudget is based on the classic envelope budgeting system, now digitized for modern users.

- Allocate funds into virtual envelopes for each spending category.

- Sync budgets with partners or family members.

- Ideal for those who want a shared financial planning tool.

5. Personal Capital – Wealth and Investment Tracking

Personal Capital is more than just a budgeting app; it offers investment tracking and retirement planning tools.

- Tracks net worth, investments, and savings.

- Provides insights on asset allocation and fees.

- Perfect for users who want budgeting plus wealth-building tools.

Why Finance Apps Matter

Personal finance apps help you stay organized, avoid debt, and achieve your financial goals—whether it’s saving for a trip, paying off loans, or building an emergency fund. With the right app, managing money becomes less stressful and more strategic.